A new academic study has made a shocking and highly controversial finding. Suspicious Israeli stock market activity in the days preceding Operation Al-Aqsa Flood on October 7 indicates that a particular party had foreknowledge of the impending attack and used that information to directly profit from the panic that ensued.

The paper, authored by Robert J. Jackson Jr. of New York University School of Law and Joshua Mitts of New York University School of Law, concludes that based on a "significant spike" in short selling of listed Israeli companies, persons unknown were aware of the operation was impending, and sought to profit illicitly. Short selling - or shorting - allows traders to bet a stock will perform poorly and reap rewards if they're correct.

Shorting is a relatively rare practice compared to traditional trading and with good reason. Losses can be vast if forecast poor performance doesn't materialize, and many investment advisors warn against engaging in the practice under any circumstances. Strikingly though, the academics found shorting of Israeli companies in days immediately before October 7 "far exceeded short selling that occurred during numerous other periods of crisis, including the recession following the financial crisis, the 2014 Israel-Gaza war, and the COVID-19 pandemic."

The pair argue this activity may reflect attempts by Hamas operatives to profit from, if not outright finance, their forthcoming attack, an allegation eagerly taken up by Hebrew newspaper Haaretz. Meanwhile, Israeli finance rag Globes attacked the study, claiming "huge errors" by its authors in overestimating the profits of individuals who shorted Israeli stocks. The pair mistakenly quoted returns in agorot, a denomination of Israeli currency, as shekels - in pennies as dollars in U.S. terms - leading them to inflate investor returns by a magnitude of 100.

Yet, the outlet acknowledged a "consistent rise in short trading balances on [Israeli] shares prior to the outbreak of the war." Moreover, the Israeli government has taken the paper's findings so seriously that an official investigation has been launched to ascertain the truth. As we shall see, there is good reason to believe that if someone sought to enrich themselves due to foreknowledge of Operation Al-Aqsa Flood, it is unlikely they were connected to Hamas.

The paper notes numerous historical precedents for such activity, which "occurs in gaps in U.S. and international enforcement of legal prohibitions on informed trading." Research on "profitable trading on the basis of information about coming military conflict" is an underdeveloped academic field. Such lack of oversight and scrutiny around shorting by Western regulators and watchdogs may explain who profited this time and why.

'Suddenly and Significantly'

The academics conclude, "Our evidence is consistent with informed traders anticipating and profiting from the Hamas attack." Concerns about the paper muddling up profit totals aside, this finding is highly persuasive. Multiple datasets reviewed therein amply show an indeed "significant spike" in short selling in the immediate leadup to Operation Al-Aqsa Flood - and a supremely suspicious one at that.

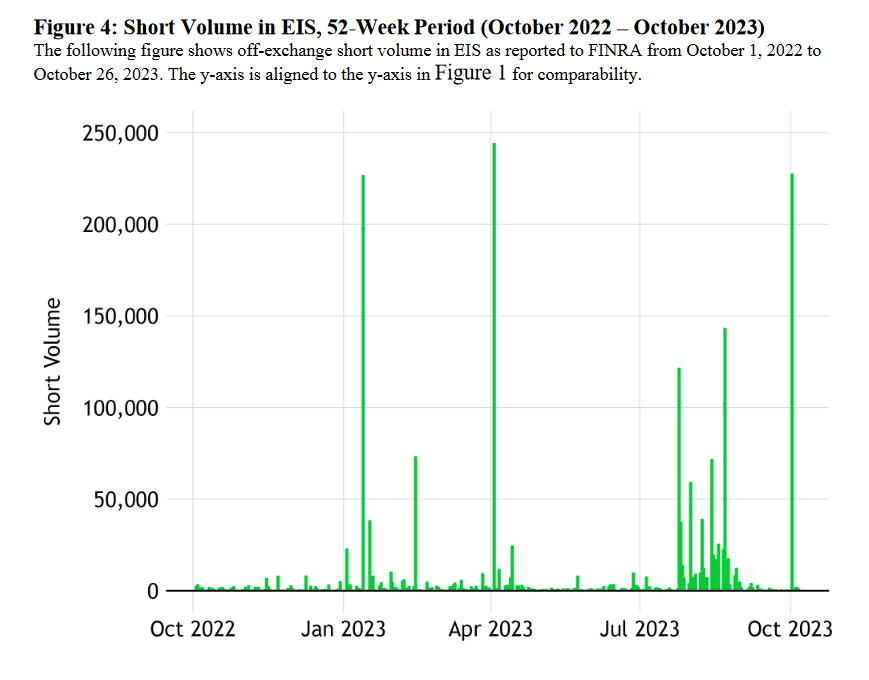

For example, the shorting of dozens of Israeli companies listed on the Tel Aviv stock exchange "increased dramatically" before the attack. One firm alone saw 4.43 million new shares shorted from September 14 to October 5. On U.S. exchanges, too, there was a "sharp and unusual increase, just before the attacks" in highly risky short-dated options being placed on Israeli stocks, which expired almost immediately after the attack started.

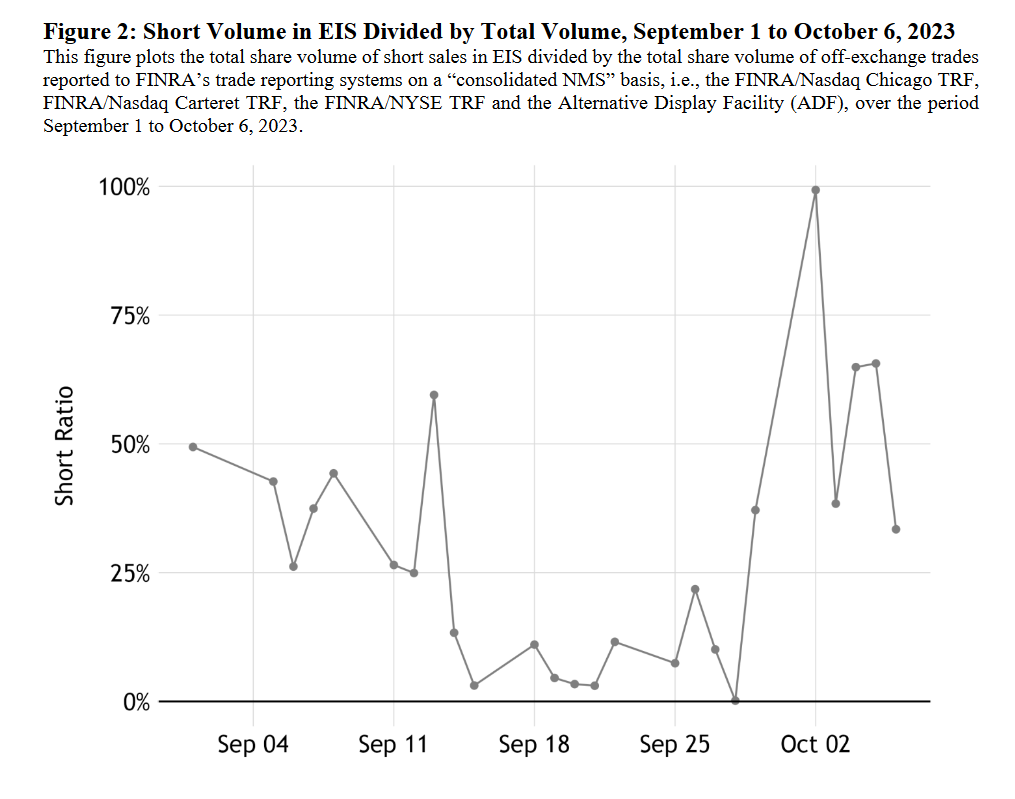

Similarly, on October 2, the shorting of the MSCI Israel Exchange Traded Fund (ETF), a passive investment vehicle tracking the performance of the Israeli stock exchange overall, "suddenly, and significantly, spiked." For context, the authors note this was the 30th-highest daily shorting volume ever experienced by the ETF over the 3,570 trading days leading up to Operation Al-Aqsa Flood. In other words, it was one of the biggest bets on poor Israeli stock exchange performance since 2009.

This shorting "far exceeded" the shorting of Israeli stocks at the start of the COVID-19 pandemic, which briefly produced one of the biggest international stock market collapses in history. In March 2020, the Dow Jones Industrial Average dropped 2000 points, effectively vaporizing trillions of dollars from the global economy, in "the biggest ever fall in intraday trading" yet recorded. No wonder the authors conclude:

It is extremely unlikely that the volume of short selling on October 2nd occurred by random chance."

Another particularly compelling finding is the identification of"similar patterns"in trading of the Israeli ETF in April 2023 - right when, it has since been reported, Hamas was planning to execute a similar attack. The strike would've followed what transpired in October closely but was canceled after Tel Aviv publicly raised its national alert level due to Israeli intelligence agencies catching wind in advance.

The attack was timed to start on the eve of Passover, April 5. Two days earlier, the shorting of the Israeli ETF"peaked...at levels very similar to those observed"on October 2. The recorded volume"was far higher (by an order of magnitude) than other days prior":

This evidence strengthens the interpretation that the trading observed in October and April was related to the Hamas attack, rather than random noise."

'Profit From Tragedy'

Exactly who was behind this activity isn't yet clear from publicly available data. Their identities will nonetheless be known by the U.S. Financial Industry Regulatory Authority and the Securities and Exchange Commission (SEC). The paper's authors suggest these agencies delve deeper to "[understand] why, and how, financial markets may have anticipated" the events of October 7.

So far, there is no sign of an official probe being launched stateside, although there are precedents for such action. As the paper records, following 9/11, the SEC looked intensively into whether particular "market dynamics" before that fateful day "reflected advance knowledge" of the attacks. Three years later, though, the Commission reported it had not been able to "develop any evidence suggesting that anyone who had advance knowledge of the terrorist attacks...sought to profit from that knowledge."

The academics add that since then, three separate academic papers have probed the same issue, pointing to very different conclusions. In 2006, University of Chicago professor Allen Poteshman concluded the activity examined by the SEC was "consistent with informed investors having traded...in advance of the attacks."

In 2011, an international study team identified "abnormal trading" indicative of "insiders anticipating the 9/11 attacks." In 2015, researchers from the University of Zurich confirmed unusual airline, bank, and reinsurer stock trading before 9/11.

The question of whether foreknowledge of the 9/11 attacks motivated insider trading was, at the time, treated with the utmost urgency by Western government officials, regulators, law enforcement, and the media. Open source records showed companies adversely affected by the event were abruptly shorted at record levels in the weeks prior, while investment in stocks that stood to benefit rocketed. On September 10, 2001, the purchase of shares of U.S. weapons manufacturer Raytheon inexplicably soared sixfold. A week later, their value had almost doubled.

The profits involved both ways were huge. As a contemporary mainstream report notes , five days before 9/11, over 2,000 short bets totaling $180,000 were made against United Airlines - ninety times more in a single day than in the prior three weeks. The company's stock collapsed once the World Trade Center was struck, and the value of that investment skyrocketed to $2.4 million. This was just one example of suspicious activity among many investigated by U.S. authorities.

Elsewhere, probes into the matter were launched in several European countries and seemingly produced quick results. On September 24 that year, Belgium's finance minister said investigations had already led to "strong suspicions that British markets may have been used" for insider trading pre-9/11. The same day, Germany's central bank president forcefully declared, "What we found makes us sure that people connected to the terrorists must have been trying to profit from this tragedy."

Yet, like the SEC's, these investigations ultimately failed to produce results. The 9/11 Commission report summarily dismissed the issue altogether on the perplexing grounds that individuals identified as responsible for the trades "had no conceivable ties to Al Qaeda." A declassified 2003 FBI document assessing suspicious pre-9/11 trades reveals who at least two of these investors were while providing a likely explanation for why authorities did not aggressively pursue the issue.

One of the trades examined by the Bureau was the purchase of 56,000 shares of Stratesec between September 6 and September 10, 2001. The company provided security systems to airports, including New York City's Dulles, from where one of the hijacked planes departed, United Airlines, which suffered two hijackings on 9/11, and the World Trade Center. Its share price almost doubled following the attacks.

The trades traced back to Wirt D. Walker III, a distant relative of the Bush family and business partner of Marvin Bush, then-President George W. Bush's brother. According to the declassified file, the FBI never bothered to interview him about the trades, ostensibly as their background investigation revealed "no ties to terrorism or other negative information."

'Point by Point'

In the wake of Hamas' October 7 incursion into Israel, shock and bewilderment abounded widely. Many reeled at the astonishing "intelligence failure" undoubtedly necessary to allow the attack to slip through the most monstrous and deadly concentration camp walls ever constructed. Multiple Israeli and Western spying veterans with intimate insider knowledge of Tel Aviv's modern surveillance and security systems expressed disbelief that such an attack could've happened in the first place, let alone taken the Israeli government by such apparent surprise.

Even Hamas operatives themselves were reportedly stunned by their success. They had not expected to be able to push so far into Tel Aviv and effectively ran out of plan past a certain point. Palestinians and their supporters have reasonably argued that Israeli Forces are a paper tiger, accustomed since their embarrassing 2006 expulsion from Lebanon to brutal imperialist crackdowns against unarmed civilians and ill-equipped for actual battle against a well-trained insurgent force.

Yet, on an almost daily basis since October 7, report after report has made it abundantly clear that Tel Aviv was given countless warnings and possessed intelligence, meaning its vast security and military apparatus duties could - should - have seen the attack coming. This begs the obvious question of why that didn't happen.

To detail just two recent examples, on November 30, the New York Times revealed how Israeli officials obtained a detailed 40-page battle plan outlining in precise detail, "point by point," Operation Al-Aqsa Flood over a year before it happened. Meanwhile, it now seems that mere hours before Hamas struck, Israeli security forces "had enough warning signs" of what was impending to prepare a response but did nothing and told no one, including attendees of the Nova music festival and its organizers.

The author of this article makes no comment on theories that Operation Al-Aqsa Flood was actively permitted to go ahead by Tel Aviv to secure a pretext for executing the horrific genocide currently unfolding in Gaza. The attack's success may well be attributable to Israel's complacency and a genuine "intelligence failure" of epic proportions.

However, countless indications that so many knew something was brewing for so long - including foreign governments and intelligence agencies - raises the prospect that someone, or some individuals with prior knowledge of Operation Al-Aqsa Flood, sought to capitalize accordingly. While Wirt D. Walker III, for example, almost undoubtedly played no personal role in planning or executing 9/11 or allowing it to happen, his privileged position and connections may have granted him access to sensitive information inaccessible to the average person.

Probing such connections and information is not something regulators and law enforcement agencies across the Western world are in the business of doing, about which shadowy actors and agencies are, of course, well aware. Tension, unrest, and cataclysmic events worldwide dependably send shares in major "defense" firms surging and often illuminate the forces responsible. Tracking which stocks are suffering, where and when, and whether anyone has sought to profit as a result may be just as incisive.

Feature photo |Illustration by MintPress News

Kit Klarenberg is an investigative journalist and MintPress News contributor exploring the role of intelligence services in shaping politics and perceptions. His work has previously appeared in The Cradle, Declassified U.K., and Grayzone. Follow him on Twitter @KitKlarenberg.